News and Events

Events

News

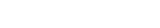

There are many activities we can do as a family to strengthen our bonds. Reading together not only gives us an excuse for quality time, it also helps the little ones become stronger readers. Here are a few tips from our friends at https://www.childrensmovementflorida.org to make reading together a routine in your home. Riding the highs, and experiencing the lows, it is the way of the investment market. However, what if we told you that the key to sound and quality investing is learning how to keep it cool when the market is in turmoil? In this article, we are going to look at some of the tools that can help you manage your emotions and expectations during market uncertainty. A college education, while a worthy achievement, does not come cheaply. Forbes has estimated that the price of a college education has increased 8 times faster than wages, making it a struggle for even upper middle-class families. When factoring in the cost of tuition along with room and board, books, and living expenses, a college education can quickly become an unaffordable luxury. Personal finance, like just about everything else, is mainly common sense. Advice like “don’t spend more than you make; start investing while you’re young; don’t loan money to friends with the expectation of getting it back,” have been around for generations, and most likely will survive the next few generations as well. Whether you’re earning a six-figure salary or just out of college, creating and maintaining a budget is a must. Having a budget that you actually use can help keep spending under control, bolster your savings account, adequately plan for retirement, and keep debt at a manageable level. With more than 95% of American workers currently covered by Social Security, there are some things about this massive retirement program that you should probably know. Media Contact: John BirneyReading Together as a Family!

Submitted by JBirney Financial, Inc. on May 14th, 2020

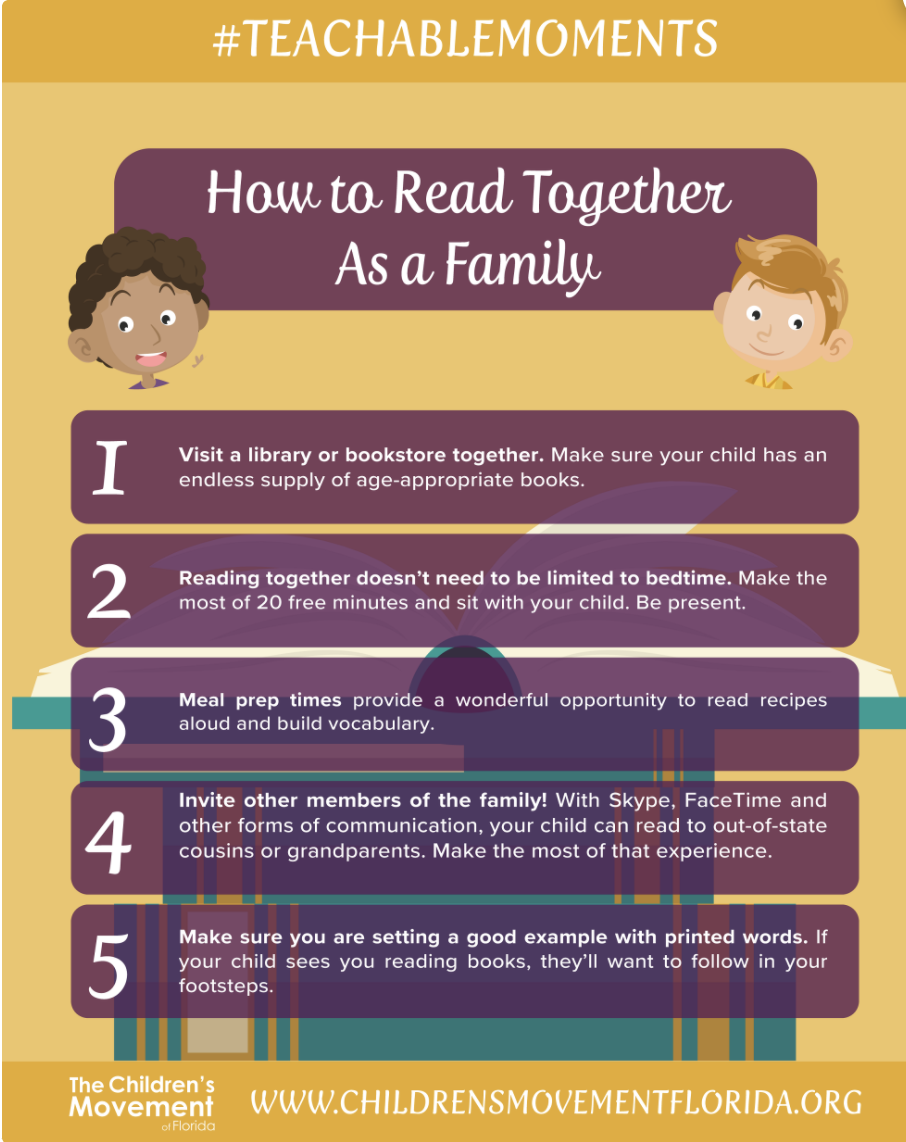

Infographic: Financial Literacy for Children

Submitted by JBirney Financial, Inc. on April 9th, 2020

Managing Emotions and Expectations during Market Uncertainty

Submitted by JBirney Financial, Inc. on March 23rd, 2020

Video:Why Financial Advisors are Still Important

Submitted by JBirney Financial, Inc. on October 28th, 2019

Getting the most out of a 529 Savings Plan

Submitted by JBirney Financial, Inc. on August 28th, 2019

Financial Missteps

Submitted by JBirney Financial, Inc. on February 7th, 2019

How to Create and Maintain a Budget

Submitted by JBirney Financial, Inc. on December 11th, 2018

Things You Should Know About Social Security and Your Retirement

Submitted by JBirney Financial, Inc. on October 17th, 2018

John T. Birney, Jr., Apprentice at JBirney Financial in Flagler Beach, recently passed the Series 66 Examination -

Submitted by JBirney Financial, Inc. on September 20th, 2018

PHONE: (386) 693-4407

CELL: (386) 931-0252

jb@jbirneyfinancial.com