Blog

Submitted by JBirney Financial, Inc. on May 14th, 2024

JB was recently highlighted in The Children's Movement's "Florida's Guide for Family Friendly Workplaces". We hope you enjoy the article. You may also click the link to learn more about The Children's Movement.

Submitted by JBirney Financial, Inc. on April 18th, 2023

Retirement can sneak up on you.

Submitted by JBirney Financial, Inc. on September 26th, 2022

Your 20s are often seen as a true coming of age when financial responsibility opens up the possibility of turning your dreams into reality. You’re settling into life after university, paying off debts, and starting to really define who you are as a person. But with bills, rent, keeping up social appearances, and other pressures, financial planning is often pushed to the side.

Submitted by JBirney Financial, Inc. on August 31st, 2022

There was a time when old retirement planning models like “the 70 percent rule” were more common. This rule stated that a retiree only needed 70% of their pre-retirement income to live comfortably in retirement. These “rules” may have worked for some retirees several decades ago but can be dangerously flawed in today’s new normal retirement.

Submitted by JBirney Financial, Inc. on April 7th, 2022

For most of us the conversation isn’t whether or not we’ll need long term care, but rather when. According to the U. S.

Submitted by JBirney Financial, Inc. on November 4th, 2021

It’s not always pleasant to think about who will take care of you when you’re no longer able to take care of yourself, but planning ahead is a necessary part of getting older. The more prepared you are—emotionally, logistically, and financially—the easier it will be for you to transition into long-term care if and when it’s needed.

Submitted by JBirney Financial, Inc. on September 20th, 2021

The first pillar of The Florida Chamber Foundation’s Florida 2030 Blueprint deals with improving our state’s talent pipeline. Two key targets in that pillar (there are six total) are Kindergarten Readiness Rates and Third Grade Reading Scores.

Submitted by JBirney Financial, Inc. on September 9th, 2021

If you’re in the 29 percent of women between ages 50 and 64 who are single, you may be wondering what retirement will look like.

Submitted by JBirney Financial, Inc. on March 23rd, 2021

John “JB” Birney is passionate about early learning education, understanding how critical it is for brain development and therefore, stronger communities.

Submitted by JBirney Financial, Inc. on March 2nd, 2021

If you have a child graduating from high school or college and entering the workforce, they may have the opportunity to open up a 401(k) through their new employer. In some cases, that employer will also offer matching contribution funds up to a certain percentage.

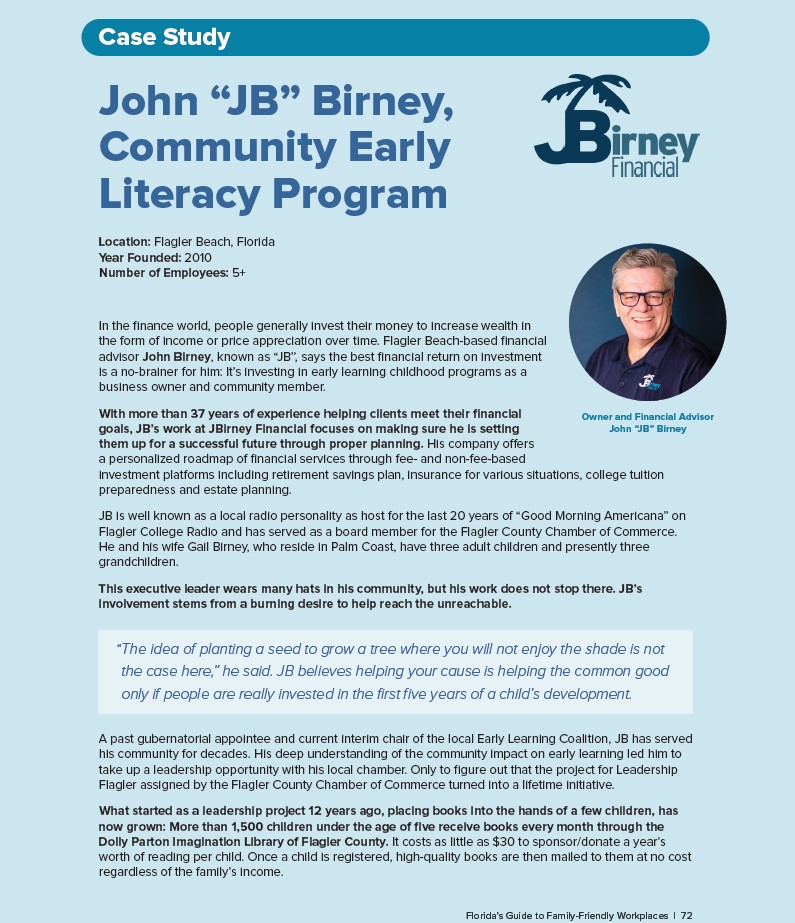

John “JB” Birney is passionate about early learning education, understanding how critical it is for brain development and therefore, stronger communities.

John “JB” Birney is passionate about early learning education, understanding how critical it is for brain development and therefore, stronger communities.